LEE COUNTY, FL (October 31, 2024) – Today, 541,741 tax bills are being mailed to property and business owners in Lee County. Property owners who signed up to receive their bill electronically will receive their emailed notice on November 1, 2024.

These bills reflect the value of the property as of January 1, 2024, when Florida law required them to be assessed.

To make it easier for customers, the Lee County Tax Collector’s Office has introduced two new payment options this year:

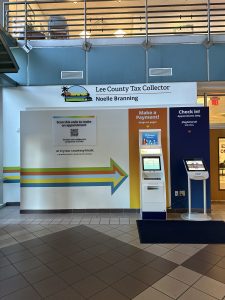

- Tax payment kiosks at all service centers which enable customers to quickly pay their bills with a credit card or eCheck and print receipts without waiting in line.

- Secure property tax payment drop boxes available 24/7 at our Downtown and South Fort Myers offices. Customers can drop off payments anytime, allow five business days for processing, and print a receipt at LeeTC.com/print-your-property-tax-receipt.

“Our mission is to deliver 5-star service to our customers,” said Noelle Branning, Lee County Tax Collector. “These new resources not only save property owners time but also provide peace of mind with secure payment options.”

In addition to these new options, tax payments can still be made online at LeeTC.com/pay-online, by mail, or over the phone.

Tax payments are due by March 31, 2025, but customers can take advantage of early payment discounts: 4% in November, 3% in December, 2% in January, and 1% in February.

This year’s tax collections are projected to exceed $2.4 billion before discounts, with all funds distributed to Lee County’s Levying Authorities to support essential services like fire rescue, law enforcement, and vital infrastructure including schools, roads, parks, and utilities.