Today, more than 562,000 tax bills are being mailed to property and business owners in Lee County. For those who signed up to receive their bill via email, those will be sent tomorrow, November 1, 2023.

These bills reflect the value of the property as of January 1, 2023, when Florida law required them to be assessed.

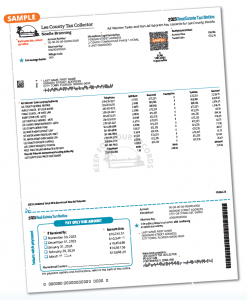

Tax payments are due by March 31, 2024, but discounts are given if paid early. Taxes paid in November receive a 4% discount, in December a 3% discount, in January a 2% discount and in February a 1% discount.

“This year’s tax collections are expected to be more than $2.2 billion before discount,” shared Noelle Branning, Lee County Tax Collector. “All dollars collected by our office are turned around and distributed to the Levying Authorities in Lee County to pay for services including fire rescue and law enforcement, and infrastructure such as schools, roads, parks, and utilities.”

This year’s tax bill has been redesigned to be easier to read and understand. In addition, resources have been created to help property owners better understand how Florida’s property tax system works, how to read a tax notice and most importantly, who to call with questions about a tax bill.

“It is our mission to deliver 5-star service to our customers,” explains Branning. “These new resources will help property owners find the answers they need quickly and pay their bills with efficiency.”

Tax bills can be paid online at LeeTC.com, via mail, over the phone, or in person at one of our six locations either by drop box, or by meeting with a customer service representative.

Property owners whose property taxes are paid through an escrow account should contact their mortgage company for information about the company’s plan for remitting escrowed property tax payments.