While it might not be the most exciting topic to discuss at a dinner party with friends, Florida’s Property Tax System is something that’s worth understanding to help manage your finances and make informed decisions.

So, let’s dive right in.

The cycle starts fresh every year, on January 1 when Property Appraisers in Florida determine the assessed value of each parcel of property in their respective counties.

Three months later, on March 1, applications for exemptions that can reduce property taxes are due to the Property Appraiser. Be sure to check with the Property Appraiser to see if you’re eligible for the homestead exemption.

Between March and July there’s a flurry of activity as Property Appraisers certify the total taxable value of all the properties in the county. That information is then shared with the local taxing (also known as levying) authorities (i.e., County Commission and City Councils) to set their proposed millage rates.

In August, Property Appraisers mail the Notices of Proposed Property Taxes (TRIM notices) to all property owners. Yours should have arrive a couple of weeks ago. These notices are not bills, but instead provide information about the value of a property, approved exemptions, and the amount that will be owed based on the proposed millage rates. If you have a question about your values or exemptions, now is the time to ask the Property Appraiser.

From September – early October, local taxing authorities hold public meetings to gather input before voting on a final millage rate. If you have questions or want to have input in the tax rate setting process, you will need to attend the public hearings. (A list of dates and locations is listed on your TRIM notice.)

Once that process is complete, the Property Appraiser certifies the tax rolls and sends them to the Tax Collector who is statutorily responsible for printing and mailing the tax bills in late October, early November. (You can also download your tax bill or sign up to have it emailed to you directly.)

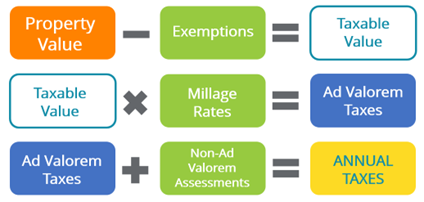

Your annual taxes are determined using the following calculation:

- Your property value, minus any exemptions, equals the taxable value of your home.

- The taxable value is then multiplied by the millage rates set by taxing authorities to determine your Ad-Valorem Taxes.

- The Ad-Valorem Taxes are added to the Non-Ad Valorem assessments, which are based on services, not the value of your property. Think storm water or solid waste assessments.

- The combined total determines your annual taxes.

Tax payments are due on March 31, but if you pay early, you receive a discount. Taxes paid in November receive a 4% discount, December is a 3% discount, January is 2% and February is 1%.

Once tax payments are received, the Tax Collector is responsible for distributing the dollars to the taxing authorities to pay for services like fire and rescue, law enforcement protection, schools, roads, utilities, and parks.

Come January, the cycle starts all over again.

So now, if your dinner party gets boring, you have something to talk about!

Noelle Branning

Lee County Tax Collector

www.leetc.com